|

| Pilgrim |

Entergy announced today that Pilgrim will close by 2019. Here are two links:

The Entergy announcement includes many subsidiary links

The Boston Globe has a good article on this breaking news.

Entergy is going to have a press conference today at noon Eastern Time. There will be more information at that time.

Some Thoughts on Pilgrim and on the Grid

There is some question about exactly when Pilgrim will close. Entergy has "contracted with ISO-NE" to supply power from Pilgrim until 2019 (Boston Globe article). This means that Pilgrim will refuel again…unless they can cut a deal with another power plant to supply power after 2017. Pilgrim's latest refueling outage started in April of this year, and it is roughly on a biennial cycle. So Pilgrim is fairly sure to keep running until 2017, but may or may not refuel at that time, depending on factors such as whether it can find another power plant to take over its obligations to ISO-NE.

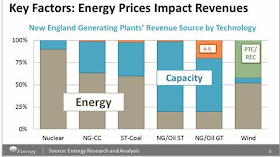

Well, all the stories say "supply power" but it is really about the capacity markets, not the power markets. Plants bid in years ahead to supply "capacity"…that is, to be available to supply power when needed. Plants are paid two ways: power payments and capacity payments.

- A plant that supplies power most of the time (base load plants) gets most of its revenue from selling power (MWh sold). This would be the case with Pilgrim.

- A plant that supplies power only part of the time (a peaker plant) gets a much higher proportion of its revenue from capacity payments (MW available when called upon). This would be the case with most gas plants.

With so many plants retiring (Vermont Yankee, coal plants), available capacity has fallen and (supply and demand) capacity payments have soared. I encourage you to look at a recent chart on Capacity Payments in the Forward Capacity Market, from James Bride's keynote presentation at an ISO-NE meeting in New Hampshire last week. The chart, on page 12 of the presentation, shows capacity payments going from $3.21 per kWmonth in 2014/2015 to $9.55 per kWmonth in 2019.

Thoughts on the ISO-NE meeting

I was at the Consumer Liaison Group meeting of ISO-NE last Friday, October 9. I am (currently) the only Vermont representative to the Coordinating Committee for that group. (Yeah. I need to do a geeky blog post on this.)

For right now, however, please look through the rest of the Bride presentation, especially the section on "missing money."

Intermittent renewables get much of their money from subsidies of various types, not from the grid. Therefore, they can bid into the grid at artificially low costs for their power, even bid in at negative numbers (we will PAY you to take our power!). This lowers the power price on the grid, and particularly hurts plants that make a lot of power, like base load plants. As base load plants retire because they can't make enough money to keep operating, the amount of capacity available diminishes, capacity payments go up, and peaker plants get proportionately more money. Peaker plants always get a higher percentage of their money from capacity payments, but when base load plants retire, they get even more money from capacity payments.

There were several presentations on the role of intermittents on the grid. Robert Ethier of ISO-NE was on the panel, and the Ethier presentation struck me as surprisingly cheery about predicting more base load plants will retire. He claimed that: power prices will go down, capacity prices will go up, but the market will take care of everything. That is my interpretation of his talk. I didn't ask him a question, but I did ask a question of Anne George of ISO-NE after her presentation. ISO-NE supposedly has some concerns with a one-fuel-source grid (natural gas) but they don't seem to be worried overmuch.

The Closing of Pilgrim Nuclear Plant is a Clear Victory for Fossil Fuels.

Update: Graphic from Bill Mohl (Entergy) press conference this morning, showing where different types of plants get their revenue. Thank you to Entergy for sharing this graphic.

Announced at the same time as China started up TWO nuclear power plants, each bigger than Pilgrim. http://www.queens.ox.ac.uk/academics/fellows/the-provost/

ReplyDeleteExcellent insights, Meredith. Thank you!

ReplyDeleteThank you, Will!

ReplyDeleteLet me also refer people to Will Davis excellent post on the Pilgrim closing at ANS Nuclear Cafe. Will's post

Thanks Meredith! I am still confused by this. Why can the nuclear units not bid capacity and make money that way?

ReplyDeleteIt is very confusing. Believe me, every time I go to an ISO-NE meeting, I discover a NEW acronym that I had never heard of before. I keep learning.

ReplyDeleteAnyhow, the nuclear units DO bid capacity and they DO get paid for capacity. Pilgrim is receiving capacity payments through 2019…to some extent, that is one of their problems. Even if they wanted to shut down in 2017, they have a contractual capacity obligation with ISO through 2019, and they have to do something about it.

But let's look at two plants that are the same size. One is a nuclear plant, and one is a gas plant. So, say they are both 500 MW and they therefore both get capacity payments (I'm making up numbers here) of $50,000 dollars per month. Fine. However, the nuclear plant will run 600 hours that month (say), close t,o 24/7, and it will get (say) $1000/hour that it is running. So at the end of the month, it has a $50,000 capacity payment and $600,000 energy payment. Less than 10% of its revenue is the capacity payment.

Meanwhile, the gas plant (same size) also gets the $50,000 capacity payment, and it gets the same amount per HOUR as the nuclear plant gets, in energy payments. It's the same size plant. BUT, the gas plant only runs 150 hours in a month…it is a peaker, or a load-follower, or whatever. So, $1000 per hour for the gas plant is $150,000, and that $50,000 capacity payment is 25% of its revenue.

So, if capacity payments go up but energy payments go down, the gas plant is "I'm all right, Jack" while the nuclear plant gets messed up big time. I've made up these numbers, but you get the idea. The chart shows it. For steady income….don't run the plant too much! Rely on capacity payments, instead!

Thanks for that explanation. It will take awhile for it to sink in, at least for me.

ReplyDeleteOne additional factor, I'm thinking, is that for the gas-fired peaker, the majority of the cost to the owner is the fuel cost. Which would be zero when the plant isn't on-line. Contrast the nuclear plant where the fuel cost is low but the fixed cost (= payroll, for an old plant like Pilgrim) is high. So the owner is losing money fast when the unit is offline.

Meredith, great article but I'm confused. Isn't power expressed in MW since it is a "flow" and capacity measured in MWh since it is a "stock". Your article expresses it in exactly the opposite way. Clarification please.

ReplyDeleteFortunately, there is already a 675 MW NGCC plant being built nearby on the grounds of an old coal plant. And the sister companies distribute NG as well as build solar & wind farms. Serendipitous, yes? www.prnewswire.com/news-releases/iberdrola-engineering-selected-to-build-combined-cycle-gas-turbine-power-plant-in-salem-ma-300008826.html

ReplyDeleteAnon. You are right. Since nuclear plants make their money with selling electricity, when they are off-line it hurts. Which means they plan outages with choreography, hire hundreds of people to work the outages, etc. Everything to get back online and keep the money coming in. Back in the day, before deregulation, when nuclear plants made a "rate of return," outages didn't use many extra people, and outages lasted for two-three months. Now, they last for less than one month.

ReplyDeleteBergan. Yes, so convenient, and just coincidence, I am sure. (sarcasm alert)

William Vaughn. I know. Sometimes the whole thing seems backwards.

But "Capacity" in this sense of "capacity payments" is "name-plate capacity." Except that it is sold as "name plate capacity available for a month." In other words, when the grid pays for capacity, it pays for the plant with this MW nameplate will be available this month, whether or not any actual MWh get made by the plant. If the name plate capacity is the same, and two plants are available for a month, they both get the same capacity payment.

But if one plant makes three times as many MWh that month, that is, one plant is on-line three times as much, it gets three times the power or energy payment as the other plant gets. (Again, more complicated because grid prices vary, but if you are on line three times as much, you ARE going to get more energy payments.) Nuclear plants run so reliably that most of their money comes from the energy payments. Gas plants don't run as much, so they get a higher portion of their money from the capacity payment.

AS is Ancillary Services. Mostly spinning and regulating reserve may include the winter reliability program, black-start capability and voltage support services where applicable and contracted by the ISO.

ReplyDelete